We gave our client the confidence to invest an estimated 11 times earnings multiples of a value of $425M

Rail Confidence was integral in providing assurance to DIF Capital Partners and Amber Infrastructure who purchased the Australian rolling stock company Rail First Asset Management.

We could mobilise in a timely manner when the opportunity to undertake due diligence was provided by the vendor. We provided robust opinions to inform the purchase on the condition of assets and rolling stock management systems to make an informed investment decision.

What we did

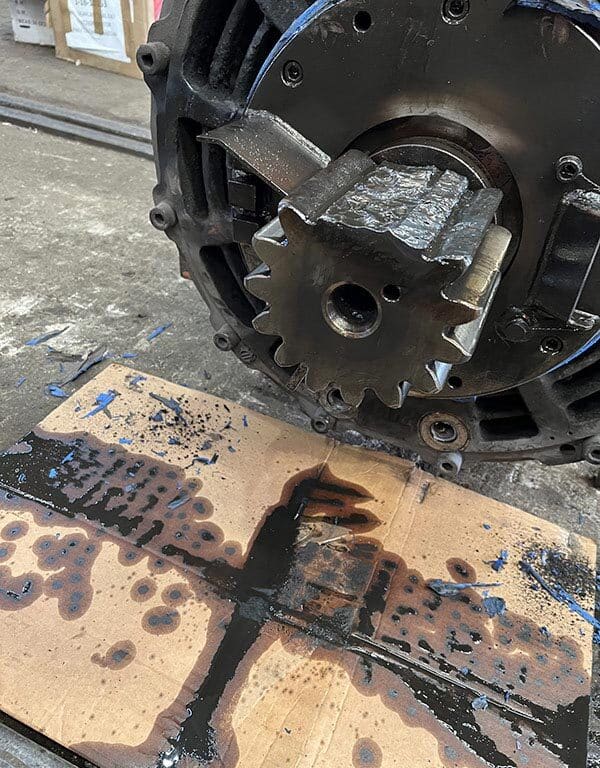

By undertaking due diligence of their locomotive maintenance facilities in Goulburn, NSW and manufacturing and maintenance facilities in Islington South Australia, along with their fleet of Rolling stock we could provide:

- Assurance on the condition of assets being invested in

- Guidance on the investment

- Insight into rolling stock management and governance being deployed and efficiency opportunities.

- Identification of risks and how to manage them.

Specific competencies:

- Understanding of various rolling stock assets and applications

- Knowledge of best practice maintenance strategies

- Rolling stock management systems and governance

- Rolling stock manufacturing and maintenance

- Risk management

This project was led by Steve Muscat and supported by Brendan Johnson and Jeremy Kelly.

How we did it

We deeply embedded ourselves in the company, gaining a strong understanding of the various assets and facilities. We asked questions, interrogated processes, investigated opportunities for efficiency and compared these findings to the decades of industry knowledge we have accumulated.

We were given small windows by the vendor to perform this due diligence. We used a risk-based approach to prioritise inspections and due diligence activities then defined the stones that could not be turned over in our report so the purchaser could understand their risk exposure.

Communications were not always with rail experts. Our report provided sufficient detail and explanation to provide an informed investment strategy also backed by sufficient technical content and evidence that would be understandable by all stakeholders.

The outcome

We provided robust opinions to inform the purchase on the condition of assets and rolling stock management systems to make an informed investment decision.

We gave our client the confidence to invest an estimated 11 times earnings multiples of a value of $425M.